Cryptocurrency, often called crypto, is a form of digital or virtual currency that uses cryptography for security. It operates on decentralized networks based on blockchain technology, a distributed ledger enforced by a network of computers. Unlike traditional currencies issued by central banks, cryptocurrencies are not regulated by any central authority, making them theoretically immune to government interference or manipulation.

Key characteristics of cryptocurrency:

- Decentralization: Cryptocurrencies operate on decentralized networks, meaning no single entity controls them. This eliminates the need for intermediaries like banks or financial institutions.

- Cryptography: Cryptocurrencies use complex algorithms and cryptographic techniques to secure transactions and verify the transfer of funds.

- Blockchain: Blockchain is the underlying technology behind most cryptocurrencies. It is a distributed ledger that records all transactions in a secure and transparent manner.

- Digital/Virtual: Cryptocurrencies exist purely in digital or virtual form and do not have a physical representation like coins or banknotes.

How does cryptocurrency work?

- Transactions: When a cryptocurrency transaction occurs, it is broadcasted to the network of computers.

- Verification: These computers, known as nodes, validate and verify the transaction using cryptographic algorithms.

- Addition to Blockchain: Once verified, the transaction is added to a block, which is then added to the blockchain, creating a permanent and tamper-proof record.

- Mining: The process of adding blocks to the blockchain is known as mining. Miners use their computational power to solve complex mathematical problems and are rewarded with cryptocurrency for their efforts.

Popular cryptocurrencies:

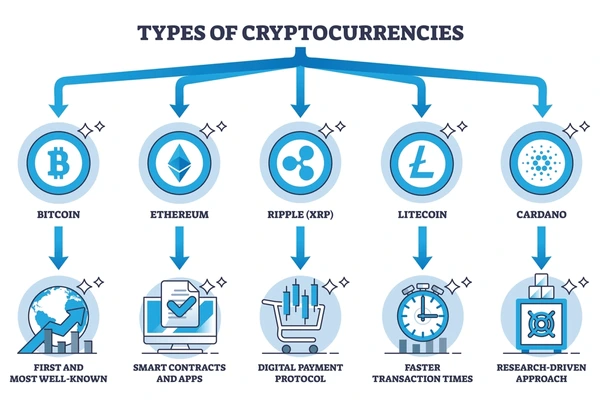

- Bitcoin (BTC): The first and most well-known cryptocurrency.

- Ethereum (ETH): A platform for creating decentralized applications and smart contracts.

- Tether (USDT): A stablecoin pegged to the US dollar.

- Binance Coin (BNB): The native cryptocurrency of the Binance exchange.

Potential benefits of cryptocurrency:

- Security: Cryptocurrency transactions are secure due to cryptographic techniques.

- Decentralization: No single entity controls cryptocurrencies, making them resistant to censorship and manipulation.

- Transparency: Transactions are recorded on the blockchain, providing transparency and traceability.

- Lower fees: Cryptocurrency transactions can be cheaper than traditional bank transfers.

Potential risks of cryptocurrency:

- Volatility: Cryptocurrency prices can be highly volatile, leading to significant gains or losses.

- Security risks: Cryptocurrencies are susceptible to hacking and theft.

- Lack of regulation: The lack of regulation in the cryptocurrency market can lead to scams and fraud.

Types of Cryptocurrencies:

- Coins: These are native cryptocurrencies that operate on their own blockchain, like Bitcoin and Litecoin. They function as digital money and store of value.

- Tokens: These are created on existing blockchains (often Ethereum) and represent assets or utilities. They can be used for various purposes like accessing services, representing ownership of physical or digital assets, or even serving as voting rights in decentralized organizations.

- Stablecoins: These are designed to maintain a stable value, usually pegged to a fiat currency like the US dollar or a commodity like gold. They are often used to mitigate the volatility associated with other cryptocurrencies.

Cryptocurrency Uses:

- Payments: Cryptocurrencies can be used for peer-to-peer transactions, online purchases, and even cross-border payments with potentially lower fees and faster processing times compared to traditional banking.

- Investments: Many people buy cryptocurrencies as an investment, hoping their value will increase over time.

- Decentralized Finance (DeFi): This is a growing ecosystem of financial applications built on blockchain technology. DeFi platforms offer services like lending, borrowing, trading, and yield farming, all without intermediaries.

- Non-Fungible Tokens (NFTs): These are unique digital assets that represent ownership of items like artwork, music, videos, or even virtual real estate. They have gained immense popularity in recent years.

Additional Considerations:

- Mining: This is the process of verifying and adding transactions to the blockchain, and miners are rewarded with cryptocurrency for their computational work. Different cryptocurrencies use different mining algorithms.

- Wallets: These are digital wallets where you store your cryptocurrencies. They can be software wallets on your computer or mobile device, hardware wallets for added security, or online wallets provided by exchanges.

- Exchanges: These are platforms where you can buy, sell, and trade cryptocurrencies for other cryptocurrencies or fiat currencies.

Important Note:

- Volatility: The cryptocurrency market is highly volatile, and prices can fluctuate dramatically. This presents both opportunities for high returns and risks of significant losses.

- Regulation: The regulatory landscape for cryptocurrencies is still evolving globally. It’s essential to be aware of the regulations in your jurisdiction.

- Security: Always prioritize security measures like using strong passwords, two-factor authentication, and reputable wallets and exchanges to protect your cryptocurrency holdings.

Cryptocurrencies are digital or virtual currencies that use cryptography for security. They operate on decentralized networks based on blockchain technology, a distributed ledger enforced by a network of computers. Unlike traditional currencies, they are not issued or regulated by any central authority. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies can be used for various purposes, including payments, investments, and decentralized finance (DeFi) applications. They offer potential benefits such as security, decentralization, transparency, and lower fees, but also carry risks like volatility, security vulnerabilities, and regulatory uncertainties.

What is cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security. It operates on decentralized networks based on blockchain technology, a distributed ledger enforced by a network of computers. Unlike traditional currencies, it is not issued or regulated by any central authority.

How does cryptocurrency work?

Cryptocurrency transactions are verified by a network of computers through a process called mining. These transactions are recorded on a public ledger called the blockchain, which ensures transparency and security.

What are the advantages of cryptocurrency?

- Decentralization: No single entity controls the currency, making it resistant to censorship and manipulation.

- Security: Cryptography makes transactions secure and difficult to counterfeit.

- Transparency: Transactions are recorded on the public blockchain, providing transparency.

- Lower Fees: Cryptocurrency transactions can have lower fees compared to traditional banking.

- Accessibility: Anyone with an internet connection can access and use cryptocurrencies.

What are the disadvantages of cryptocurrency?

- Volatility: Cryptocurrency prices can be highly volatile, leading to significant gains or losses.

- Security Risks: Cryptocurrencies are susceptible to hacking and theft.

- Limited Acceptance: Not all merchants accept cryptocurrency as payment.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving.

What are some popular cryptocurrencies?

- Bitcoin (BTC): The first and most well-known cryptocurrency.

- Ethereum (ETH): A platform for creating decentralized applications and smart contracts.

- Tether (USDT): A stable coin pegged to the US dollar.

- Bianca Coin (BNB): The native cryptocurrency of the Bianca exchange.

How can I buy cryptocurrency?

You can buy cryptocurrency on cryptocurrency exchanges, peer-to-peer marketplaces, or through Bitcoin ATMs.

Is cryptocurrency safe?

Cryptocurrency transactions are secure due to cryptographic techniques. However, it’s important to store your cryptocurrencies in a secure wallet and be aware of potential scams and fraud.

Should I invest in cryptocurrency?

Cryptocurrency can be a high-risk, high-reward investment. Before investing, do your research, understand the risks, and never invest more than you can afford to lose.

Pingback: weight lose for healthy life

Pingback: Best Crypto Exchanges, Apps & Platforms - SmaartLivingTech.com